There's a reason MoneyWeek is Britain's best-selling financial magazine. We exist to help you ground your portfolio so that it keeps your money safe during rough patches and growing in the good times. We don't just look at how to maximise your returns and limit your losses, we also like to look at how you can keep more of the money you've made.

Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor-in-chief...

Unwelcome neighbour of the week

Good week for

Bad week for

US inflation brings no respite for markets

Chinese stocks rally as crackdowns ease

US mulls new rules for brokers

Viewpoint

The new kings of Wall Street

■ Refining margins rocket

Go-Ahead gets snapped up • Bus and train firm Go-Ahead has accepted a takeover offer, but a higher bid could still be on the way. Matthew Partridge reports

Coinbase braces for crypto winter

City talk

MoneyWeek’s comprehensive guide to this week’s share tips

A Swedish view

IPO watch

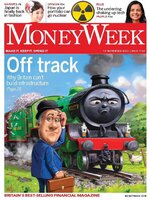

“Benefits to Bricks” is all bluff • Boris Johnson’s ideas on housing are built on flimsy foundations. Emily Hohler reports

A critical turning point in the war in Ukraine

Johnson reopens Brexit wars • Britain is tearing up parts of its deal with the EU. Matthew Partridge reports

The Trump soap opera continues

Betting on politics

News

The way we live now... the robots coming for your order

The Brussels effect • Rules dreamt up by EU bureaucrats have a habit of being enforced globally. Why is that? And is it such a bad thing? Simon Wilson reports

We can’t borrow our way out of this • Racking up debt to deal with a cost of living crisis is crazy. We should cut our coat according to our cloth

Who’s getting what

Nice work if you can get it

When will the bear end? • US stocks are now in bear market territory. Can history tell us when a bottom is likely?

I wish I knew what an IPO was, but I’m too embarrassed to ask

Guru watch

Best of the financial columnists

Money talks

Trees, too, are sick of city life

www.theconversation.com China’s population crunch

Why bad leaders thrive

Class peace will cool inflation

The digital infrastructure boom • Two established players and a business with great potential stand out in the ailing tech sector

Activist watch

Short positions... Odey recoups his losses

Investors beware – the 1970s nightmare is back • It’s too late to worry about a return to the 1970s, writes Barry Norris, founder of Argonaut Capital – we’re already there. The more important question for investors now is: what can you do about it?

What you should invest in as the 1970s return

Get ready for the coming oil glut • Investors are assuming that energy prices will stay high. History suggests the opposite, says Max King

Don’t rush into an energy fix • Deals are becoming more tempting, but not all households can benefit

Child benefit’s surprise bills

Pocket money... time to unplug your wine fridge

A way to get paid faster • Invoice finance could help your business cope with late payments

Brace for the rail strikes

Petty cash... don’t overlook the EIS

Getting back to work • Hays has been volatile, but results are strong and...

1204

1204

1203

1203

1202

1202

1201

1201

1200

1200

1199

1199

1198

1198

1197

1197

1196

1196

1195

1195

1193

1193

1192

1192

1191

1191

1190

1190

1189

1189

1187

1187

1186

1186

1185

1185

1184

1184

1183

1183

1182

1182

1181

1181

1180

1180

1179

1179