There's a reason MoneyWeek is Britain's best-selling financial magazine. We exist to help you ground your portfolio so that it keeps your money safe during rough patches and growing in the good times. We don't just look at how to maximise your returns and limit your losses, we also like to look at how you can keep more of the money you've made.

Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor-in-chief...

Career move of the week

Investors dash into the US dollar

Base metals in freefall – will growth follow?

New Zealand’s housing falters...

... as global property bubble bursts

Viewpoint

High prices are the best cure for high prices

Musk turns back on Twitter • The billionaire investor has withdrawn his bid for the social-media platform, triggering a legal imbroglio. Matthew Partridge reports

Bill Ackman finds nothing to buy

Drug giant on a shopping spree

MoneyWeek’s comprehensive guide to this week’s share tips

A German view

IPO watch

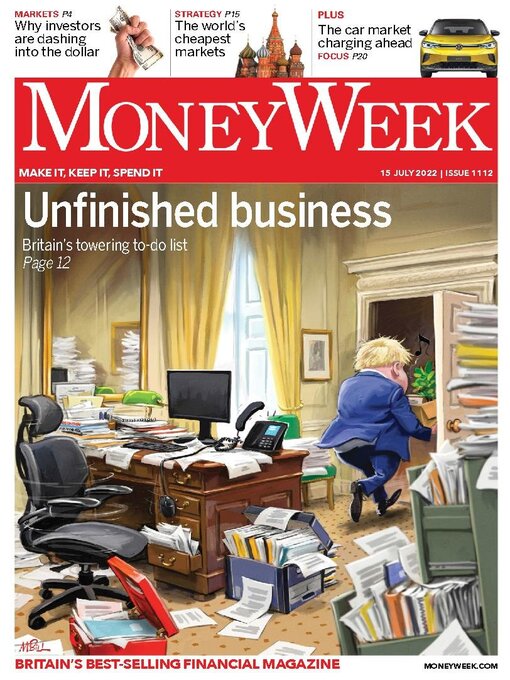

Who will be the next PM? • The race is on to replace Boris Johnson. Who has the right credentials? Emily Hohler reports

Who Keir Starmer should be praying for

Shinzo Abe’s legacy • The murder of Japan’s former PM may spark reform. Matthew Partridge reports

Putin cuts off the gas to Europe

Betting on politics

News

Britain’s towering in-tray

The tax cut that would do most good • Tory leadership candidates are promising tax cuts. This is the one that the winner should prioritise

City talk

Are markets cheap yet? • We’re always telling you to buy when assets are cheap. So are any global markets looking appealing yet?

I wish I knew what the CAPE ratio was, but I’m too embarrassed to ask

Guru watch

Best of the financial columnists

Money talks

The crypto craze is over

A new paradigm takes hold

Fun no longer mandatory

WFH puts a lid on inflation

Income and reliability in biotech • The BioPharma Credit investment trust lends to promising small drug developers

Activist watch

Short positions... a new index tracking hedge funds

Invest in the car market – it’s charging ahead • The vehicle sector suffered badly in the pandemic, and has since been buffeted by supply-chain problems, inflation and recession fears, says David J. Stevenson. But electric cars are thriving

The curious case of Adler • The story behind the struggling German property group is tangled, but one lesson is simple, says Bruce Packard

Maximise holiday money • Foreign holidays are making a comeback now that restrictions have gone. Ensure that your pound stretches as far as it can while you’re abroad

Dealing with lost luggage

Pocket money... don’t fall for scammers’ latest wheeze

How to avoid a wage spiral • Demands for higher pay are spreading. How should small firms react?

Battling your energy bills

Petty cash... fraud crackdown hits R&D

Ashtead’s solid foundations • The building-equipment rental firm’s prospects are auspicious

Trading techniques... transfers of power

How my tips have fared

These companies will conquer the competition • A professional investor tells us where he’d put his money. This week: James Harries of the Securities Trust of Scotland picks three long-term...

1204

1204

1203

1203

1202

1202

1201

1201

1200

1200

1199

1199

1198

1198

1197

1197

1196

1196

1195

1195

1193

1193

1192

1192

1191

1191

1190

1190

1189

1189

1187

1187

1186

1186

1185

1185

1184

1184

1183

1183

1182

1182

1181

1181

1180

1180

1179

1179